Single-Family Rentals – A Perspective

Most real estate investors are in it for the long haul. We look at our property investment performance over years, even decades.

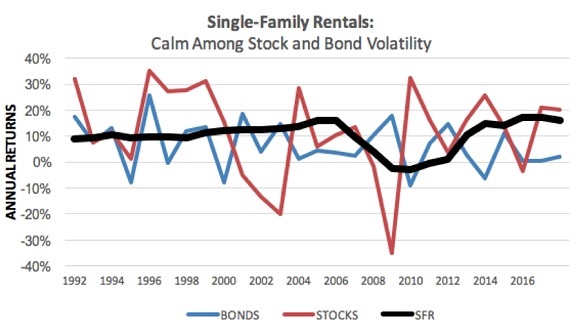

Single-family rentals have an impressive long-term track record. The chart below illustrates the annual returns from stocks, bonds, and single-family rentals:

The steady, black line tells it all – single-family rental total income (appreciation plus rental income) is reliable and not subject to nearly as much volatility as stocks and bonds. If I showed you this same chart over the last hundred years, it would look remarkably similar to this one.

Since 2009, homeownership has declined by 3.6 million, and the number of renters has increased by 1.9 million. Why? Higher home prices, demographic shifts, and an increased desire for flexibility. Pew Research studies show that the millennial generation, now constituting roughly half of all households with children, are more likely to rent than own a home. The consensus is that the single-family home rental market in the United States will remain strong into the foreseeable future.

We are enjoying an era of low interest rates. That means you can invest in single-family homes with leverage to increase returns. Suppose a single-family home investment property is purchased for $450,000 with no mortgage. In that case, the cash on cash returns are good, but if that same property is acquired with a $100,000 down payment and a $350,000 mortgage at 4% or so, the ROI is much higher.

I’m bullish on rental real estate. Why? Here’s how I see it –

Real estate is a tangible asset. As the old cliché goes, “God isn’t making any more land.” No market is foolproof, but if you like your wealth placed primarily in tangible assets, single-family homes are an excellent vehicle for you.

Stocks are more volatile than real estate. We all remember 2008. There is no doubt that real estate values can and do fluctuate. Stocks rise and fall daily, whereas real estate values are less affected by national economic cycles.

The income stream from real estate is hard to beat. Often, people buy bonds and other debt instruments for income. With bond yields now at or near historic lows (low interest rates equal low bond yields), where does an investor turn for income? Rental real estate is the best option.

As inflation rises, real estate provides some protection. If we are entering an era of higher inflation, real estate values (historically) increase along with general inflation, often at a higher rate.

In life, it’s easy to get caught up in the hype. A hot stock or cryptocurrency play could make you a serious profit in a hurry, or it could wipe out your entire investment. If you’re the type of person who likes to sleep at night and not worry about wild valuation swings, rental real estate is very likely your best option.

The biggest downside to investing in rental real estate is perhaps the associated tasks required to service your investment – rent collection, tenant communications, repairs, etc. For some investors, especially if they only own one or two rental properties, taking care of these things is no big deal. But many investors simply do not have the time or desire to deal with these issues. That’s where we come in.

Sterling Property Solutions handles everything for you – property marketing, tenant screening, rent collection, maintenance, property inspections, and financial reporting. We provide top-tier customer service to both our property owners and our tenants. We ensure that everyone who interacts with us feels valued and has a positive experience.

So, now is the time! It’s not too late to become a rental real estate investor. The long-term outlook for the rental market in Westchester is very bullish. If you’re brand new to the rental property investment market, we can help you get started the right way. If you’re an existing rental investor and you either don’t have the time or the interest to manage your properties any longer, reach out.

At Sterling Property Solutions, we have a team in place that can answer all your questions and address any challenges. Together, let’s put in place a robust, long-term program for your success. Please give me a ring at 914-355-3277 or send me an email at Linda@Sterlingpsi.com.